Travel insurance for digital nomads

It’s great that as a digital nomad, travel insurances assures you that you are protected from the losses that you might suffer while travelling. But the issue is that the majority of travel insurance plans are made to last for a specific period of time, and you might need to present a return ticket in order to obtain the insurance coverage itself.

As a digital nomad, I understand that this might be a huge issue because generally digital nomads are constantly on the go. We normally visit our home countries for only short period of time and on top of that we don’t know when that would be. That’s why the insurance plan for digital nomads should be different from the typical travel insurance plans.

Fortunately, several insurance providers have developed programmes expressly for digital nomads.

You’re thinking of having a holiday or travelling because of your work, or decided to working remote? While this may appear simple, like booking a flight or hotel, but life on the road may be unexpected. To be fully ‘travel ready,’ you’ll need travel insurance to safeguard not just yourself, but also your belongings like laptops, expensive cameras or something valuable.

Finding reliable and suitable travel insurance companies might be hard and tricky.

But, don’t worry, I’ve done that homework and also found top 10 travel insurance companies for the travellers and digital nomads.

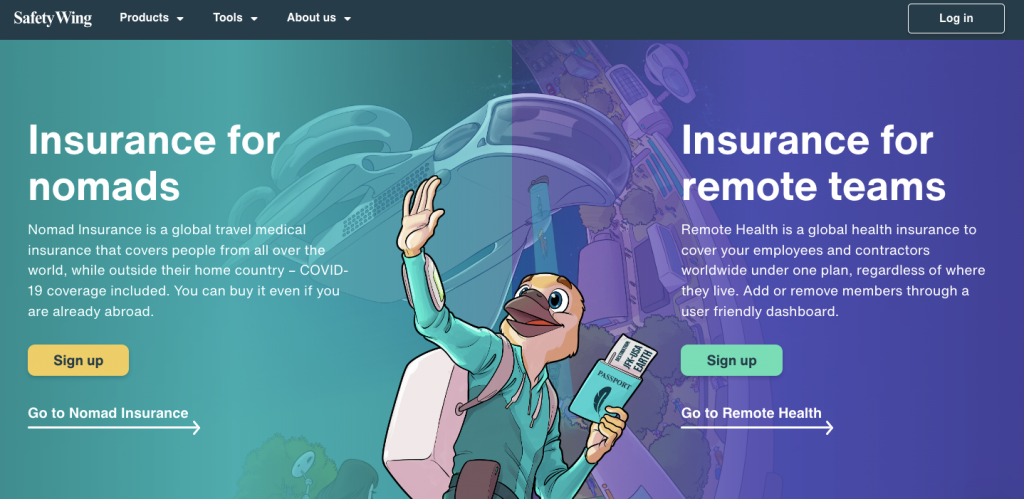

Safety wings:

In more than 175 nations, Safety Wing travel insurance provides cost-effective, high-quality coverage for digital nomads. Therefore, with safetywings, you can visit any country with without hesitation, and you get great value for your money.

https://safetywing.com/?referenceID=nomadlife&utm_source=nomadlife&utm_medium=Ambassador

Pros:

- With safetywings, you can cancel your subscription anytime you want to. Honestly, this is the best part that I love about safetywings.

- The majority of travel insurance providers will want information about your travel dates and the countries you plan to visit. But, with safety wings, you may get travel insurance from on a 28-day subscription basis. Unless you decide to cancel, it renews automatically.

- Two children under the age of 10 are covered under each adult’s nomad insurance policy from SafetyWing.

- You can start your safetywings travel insurance policy even if you’re outside your home country.

- When you renew your coverage every 90 days, you are insured in your home country for up to 30 days (or 15 days for US nationals), making it simple to visit friends and families there.

Cons:

- Flight delays and cancellations are not covered.

- For coverage in the event of a scooter or motorcycle accident, you must have an international motorbike licence.

- Making claims with SafetyWing Insurance might be challenging. The processing alone might take months. It took me 8 weeks to be my money from safety wings after I made the claim.

4. There is no coverage for “high-risk” sports.

2. World nomads:

Another famous travel insurance provider for digital nomads is world nomads. You can rely on World Nomads to have your back on your international trips, given its years of expertise in this area. The cost of World Nomads’ travel insurance is often a little costlier than the other companies, but they also provide some special advantages. When it comes to insurance claims, World Nomads has a great reputation. Many customers claim that the procedure was short and simple, and their customer service is top-notch.

There are many exclusions in travel insurance policies, so it’s important to understand what is and isn’t covered to avoid unpleasant surprises.

Exclusions from World nomads include:

- Previous condition or illnesses: World Nomads does not cover pre-existing conditions, therefore if you sought medical care for any sickness or condition during the 90 days before the starting of the policy, you may be responsible for the cost of such care going forward.

- Intentional/ conscious acts: Losses incurred as a result of criminal conduct, drug usage, drunkenness, or self-harm are not reimbursed.

Pros:

- Good protection plan against the theft and loss of valuable equipment, particularly electronic equipment.

- Good customer service and a reputation for paying claims promptly

- It provides coverage for incidents of terrorism and assault. This assures the security to the travellers to hostile nations.

- You can also get coverage for “high-risk” sports.

Cons:

- With World nomads, the cost of travel insurance for digital nomads is higher.

- Depending on the countries you visit, the costs might change dramatically.

- Even if you have an international driving licence, it might be challenging to get them to cover accidents involving a scooter or a motorcycle.

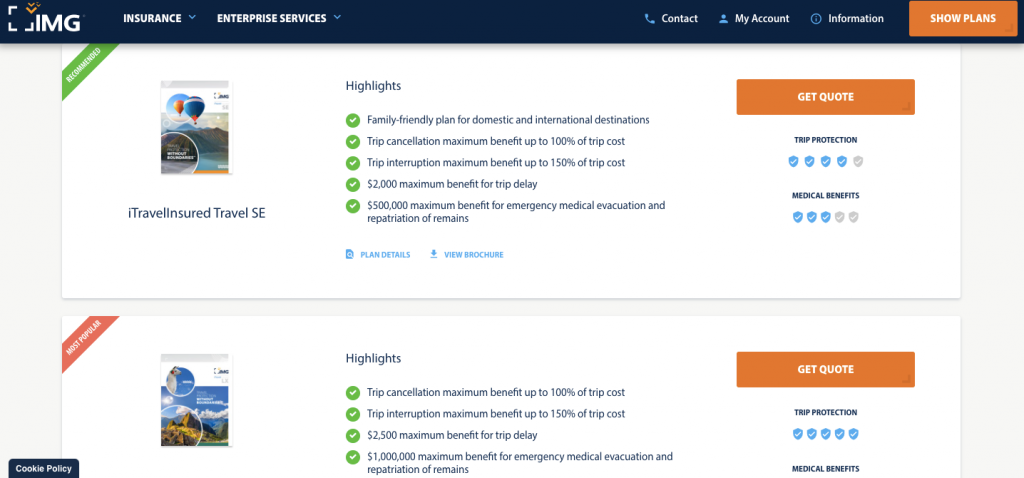

3. IMG Global Travel insurance:

IMG Global travel insurance has a solid record for making insurance claims. They have some really positive reviews and well known for their excellent customer service. Their prices are also very competitive as they have good financial background. They are very flexible with the coverage they provide.

They have 2 insurance categories:

- Travel Medical Insurance

- Travel insurance.

Pros:

- IMG Global provides exceptional customer service and known for resolving the claims quickly.

- You can get a price that you’re comfortable with because they are flexible to customize your plan to match your requirements.

- They are not as expensive as world nomads. The health and travel insurance offered by IMG Global are also affordable.

- They have coverage options for high risk activities such as skiing, bungee jumping, and scuba diving. In case you get lost, you may also get up to $10,000 in coverage for a search team.

- The application process as well as extending the policy is simple and easy.

- Some plans permit cancellation or suspension for any reason without incurring additional costs.

Cons:

- Your travel insurance policy will be terminated if you return home for more than 14 days. This rule applies for most countries and for the USA, your policy will be cancelled immediately upon returning.

- You must make an upfront payment, prior to receiving reimbursement from your health insurance provider.

- There is a waiting period, before you can submit a claim for lost luggage or a cancelled trip with IMG Global.

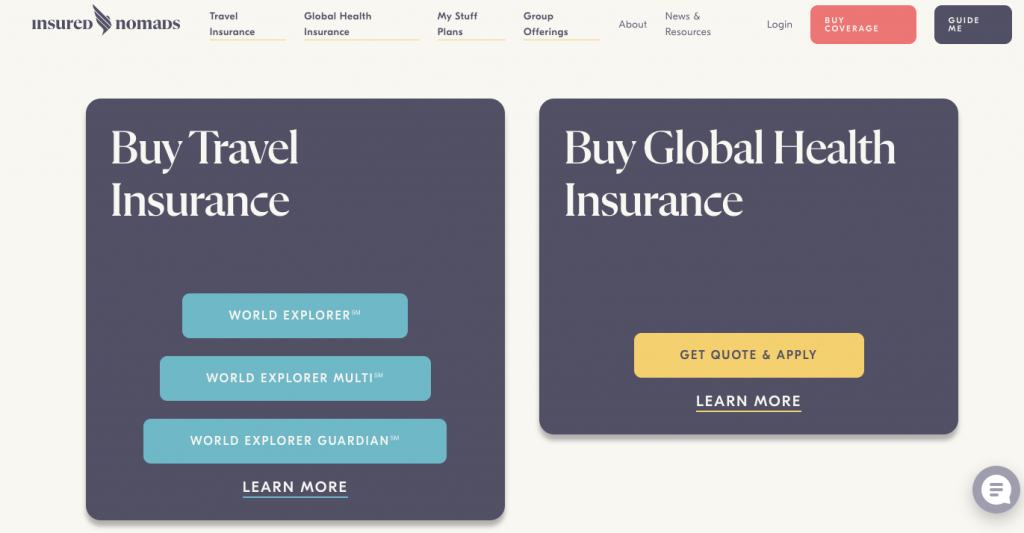

4 Insured Nomads:

With locations in the UK and the USA, Insured Nomads provides travel and international health insurance for remote workers and digital nomads.

One of the most comprehensive insurance coverages are offered by Insured Nomads. It provides evacuation and repatriation insurance for those who work remotely. Additionally, it has plans for lost luggage, transit issues, and delays in travel-related property losses.

Moreover, Insured Nomads offers health insurance.

Pros:

- The application process is simple and easy.

- Covers lots of activities such as mountaineering, scuba diving, bungee jumping and many more

- They have excellent customer support system.

- It is perfect for short term travellers.

Cons:

- The cost of traveller’s insurance might be expensive

- You have to mention your travel dates.

5. Atlas Travel Insurance

Atlas travel insurance is famous amongst the travellers and digital nomads for their flexibility. With Atlas, you can completely customize your travel insurance plan. You can customize your plan by selecting your deductible, duration of coverage, and total coverage limit.

Pros:

- It provides medical Emergency Evacuation Benefit

- Customizable insurance packages that allow you to just pay for the coverage you need.

- Most plans include trip cancellation coverage, and Atlas offers optional coverage for cancellations.

- You can get Atlas medical insurance

- Additional travel benefits includes trip cancellation, travel delays, and lost checked luggage.

Cons:

- Only clothing and personal things are covered for lost items, with a maximum loss benefit of $50 USD per item.

- You must provide your travel dates so that they can estimate how long your travel is going to be.

6. Aardy travel insurance:

Nomads weigh a variety of criteria before selecting an insurance plan. Cost, coverage, claim limitations, and client feedback are a few of these. Checking everything to make sure you made the proper choice is neither practical nor efficient. But with Aardy, you can compare and buy the finest travel insurance from all the main providers using the AARDY Travel Insurance Marketplace.

The comparison website operates as follows:

- All you have to do is visit the website and begin describing your trip and yourself.

- Depending on your responses, AARDY will modify the search results.

- Pre-set your choices before beginning your search in order to prevent receiving results that doesn’t suit your requirements.

- You will find your travel insurance, once you know what type of coverage you require.

Pros:

- A plan can be easily chosen and purchased on its website.

- It provides exceptional customer service. In regard to travel and medical insurance, their representatives are highly educated and quick to answer.

Cons

- Aardy cannot offer travel insurance deals like other insurance companies, it only allows you to compare travel insurance plans and quotes.

7. Genki Nomad Medical Travel Insurance

Genki’s travel insurance plan provides full transparency, and it is really easy to sign up. They charge a monthly fee that is automatically renewed for up to two years. Even their monthly plans renews automatically. This implies that you are free to buy and terminate your insurance plan whenever you choose. Genki travel insurance policy was designed based on the digital nomads, therefore there is no need to make a long-term commitment. It also provides coverage for a lot of sports activities.

Pros:

- With an affordable monthly fee, it provides excellent value for money.

- You can enjoy ongoing coverage for up to two years with the subscription model.

- Claim payout timings are the quickest amongst any travel insurance provider.

- You can buy their policies, even outside your home country.

- The signup process is simple and easy.

- Genki is funded by Allianz Partners and DR-WALTER, two well-known insurance businesses.

Cons:

- Doesn’t provide coverage for flight delays trip interruption or lost checked baggage.

- Their coverage plan for people aged 30 plus is higher.

Honestly, my I think Genki gives you more than safety wings at affordable cost.

8. InsureMyTrip:

InsureMyTrip has years of experience in the field of travel insurance. Their website offers a range of programmes from different companies which allows you to compare insurance policies side by side. To choose which plan best suits your needs, you can evaluate various options wisely.

Comparison websites like InsureMyTrip are life-saving tools in my opinion. With a few clicks, you may get a well-curated selection of travel insurance for remote employees.

The best aspect of InsureMyTrip is its comprehensive medical coverage and mental health treatment coverage.

Pros:

- When it comes to assisting clients in finding a reliable travel insurance provider, InsureMyTrip works great as a comparison website for travel insurance.

- Excellent customer service

Cons:

- InsureMyTrip acts as a third party service.

9. AIG Travel Guard:

Global insurance provider AIG Travel Guard offers a number of different travel insurance plans.

Travel Guard provides three complete packages:

- Deluxe,

- Preferred

- Essential.

They provide trip cancellation insurance that covers up to 100% of the trip cost.

Additionally, their famous “Pack N’ Go” strategy is great for last-minute tourists. The cancellation coverage is irrelevant to them because their trips are not preplanned. This plan includes provisions for travel cancellation, luggage insurance, emergency airlift, repatriation of remains, etc. So, it’s great for digital nomads.

Pros:

- The procedure for enrolling in an insurance policy is simple and straightforward.

- To suit various lifestyles, Travel Guard provides a range of insurance coverage options.

- To assist their customers, they offer 24-hour, seven-day-a-week service throughout the world.

- AIG Travel plans are backed by over 25 years of industry expertise and a network of service centres in Asia, Europe, and the Americas ready to assist passengers both before and during their trips

Cons:

- Despite making the claim to be a worldwide insurance company, the majority of its plans aren’t offered everywhere.

- Although the “Cancel for Any Reason” upgrade is offered, it costs just 50% of the trip fees, as opposed to 75% from most rivals.

10. Travelex Insurance

Travelex has dominated the market for travel insurance for more than 20 years. With today’s diversified traveller in mind, they have created each of their protection plans to meet their demands. They provide both standard comprehensive travel insurance benefits and special benefit enhancements that let you personalize your trip protection.

Travelex has had great success in developing and providing unique insurance products and services at a reasonable price. They also provide excellent customer service.

Hospitalization, urgent care, and other medical costs are no longer an issue with travelex Insurance because It provides coverage for up to $50,000 in emergency medical or dental expenses for digital nomads.

Your younger minor children are covered by your digital nomad health insurance until they turn 17. In terms of family, Travelex insurance is the best as you don’t have to pay extra premiums.

Pros:

- Includes free coverage for children age 17 and under when accompanied by a grown-up who is insured.

- Provides coverage for sports and other outdoor activities.

- A very good coverage of $2,000 per person after a five-hour wait is offered.

- You can change your travel plans without being charged extra.

Cons:

- The benefits for baggage delay applies only after a 12-hour wait.

- The annual coverage cost is not cheap.

Conclusion:

As a digital nomad or a traveller, it is very important that you have a suitable insurance policy from a reliable insurance company because there might be an unexpected accident sometimes, you might get sick and might need medical attention, sometimes financial loss migh incur or flights might get cancelled. Therefore, it’s better to travel with peace of mind and for that you need appropriate coverage against the uncertainties.

You can always change the insurance provider because you aren’t restricted to using only a single source of insurance for digital nomads. Every day, more companies are offering a variety of travel insurance policies. So, you can just shop around and choose the best one suitable for you.

I’m not a licenced insurance agent. This is my personal perspective and my own study findings. Therefore, please always verify an insurance provider before buying travel insurance to ensure you’re getting the greatest coverage for your needs.

How much a travel insurance for nomads cost?

Depending on the company and the type of coverage, digital nomad travel insurance often costs between $35 and $140 per month.

Generally speaking, the coverage is often greater the more you spend, but that’s always not the case. The most important factor amongst all is that your nomad insurance is flexible enough to fit your way of life and covers only and all that you require.

Which insurance provider I am using right now?

I have been using Safety Wings for the past 4 years, and I am very comfortable and happy with it at the moment. I’ve even made my insurance claim with them a couple of times. It did take a long time to get my money from that claim, but eventually I received 100% of what I was promised.

They have many benefits included in their policies, and you don’t need to specify a policy duration. A set cost is paid for 28 days, after which the subscription renews itself.

Always, ensure that their policy is appropriate for you by checking their policy’s inclusions.